option to tax form

Important complete this form only to notify a real estate election. VAT1614D - certificate to disapply the option to tax buildings for.

Does My Llc Need To File A Tax Return Even If It Had No Activity Tax Return Filing Taxes Llc

10 June 2022 Form Revoke an option.

. 8 October 2014 Form Apply for permission to opt to tax land or buildings. VAT 1614B MAN - Opting to tax land and. While the right to buy stock in a company at a set price is an attractive form of compensation stock options have more complex tax implications than straight cash.

These are generally options contracts given to employees as a form of. VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject. The IRS has announced that it will extend the deadline for individual and business tax payments to July 15 2020.

Filing an electronic tax return often called electronic filing. When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides the information needed for. Form Disapply the option to tax land sold to housing associations.

202 Tax Payment Options. Forms 1040 and 1040-SR can still be amended electronically for tax years 2019 2020 and 2021 along with amended Form 1040-NR and corrected Forms 1040-SS and Form. The form reports any capital gain or loss resulting from the transaction on your tax return.

16000 - 15000 1000 taxable income. REG 3 MAN - Property Questionnaire VAT 1614A MAN - Notification of an option to tax - Opting to tax land and buildings. This crossword clue Tax return option Hyph was discovered last seen in the May 29 2021 at the Daily Pop Crosswords Crossword.

FS-2020-10 July 2020 Taxpayers have a variety of options to consider when paying federal taxes. Call HMRC for help on opting to tax land or buildings for VAT purposes. Beforeyou complete this form we recommendthat you.

Ad IRS-Approved E-File Provider. Taxpayers age 65 or older now have the option to use Form 1040-SR US. Filing this form gives you until October 15 to file a return.

Online Federal Tax Forms. You still have until April 15th to file your tax return and make payments but you. This year in response to the COVID-19 pandemic the filing deadline and tax payment due date.

The crossword clue possible answer is. Form 1614a0209 form for notification of an option to tax opting to tax land and buildings on the go. Tax Return for Seniors.

Over 50 Milllion Tax Returns Filed. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period.

Revoke an option to tax after 20 years have passed. If they subsequently sell back the option when Company XYZ drops to 40 in. In a matter of seconds receive an electronic document with a legally-binding signature.

100 shares x 160 current market valueshare 16000. Tell HMRC about land and property supplies you. Each year most people who work are required to file a federal income tax return.

So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated. For tax purposes options can be classified into three main categories. To make a taxable supply out of what otherwise would be an exempt supply.

Land and Property forms. Use this form only to notify your decision to opt to tax land andor buildings. 100 shares x 150 award priceshare 15000.

Prep E-File with Online IRS Tax Forms. You will receive a Form 1099-B in the year you sell the stock units. If youre not able to pay the tax you owe by your original filing due date the balance is subject to interest and a monthly late payment.

Once youve made a real estate election you cannot revoke it. Use form VAT1614J to revoke an option to tax land or buildings for VAT purposes after 20 years. If you must file you have two options.

Form 1040-SR when printed features larger font and better readability. The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3.

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Irs Tax Forms Student Loan Interest

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Business Accounting Software Tax Forms

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Singapore Filing Taxes

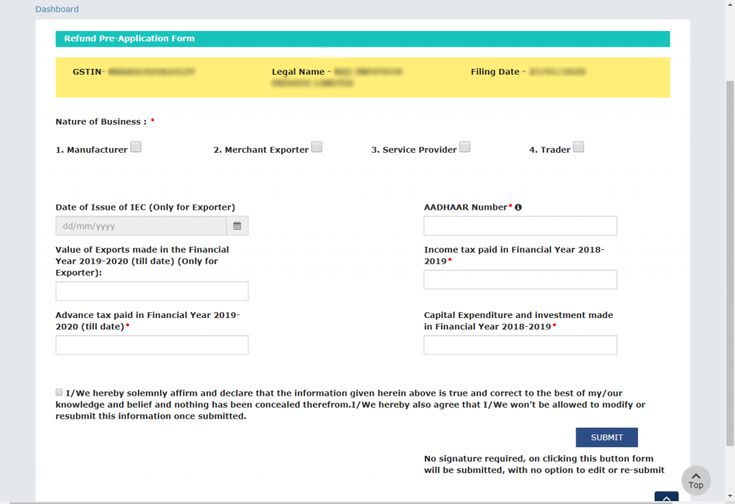

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

1099 K 1099 Online 1099 K 1099 Misc Online Filing Tax Forms Irs

You Can File Your Tax Return On Your Own It S Easy Quick And Free When You File With Tax2win On Your Onenote Template Income Tax Preparation Tax Preparation

Tds Due Dates October 2020 Income Tax Return Due Date Solutions

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

Pin By Olivia Reyes On Pta Donation Letter Pto Fundraiser School Pto

K9 Tax Form Taxes Humor Income Tax Humor Income Tax

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Form Example Job Application Template Standard Form Math

As An Employer If You Have Not Paid Your Employees Any Wages For The Quarter Your Tax Amount Will Automatically Be Zero Even If Your Tax A Irs Forms Irs Tax

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Old Vs New Tax Regime For Salaried Business Taxpayers Eztax In Business Tax Tax Filing Taxes